GoMobile® is now goVivo®!

Experience a smarter, more seamless way to manage your finances with goVivo.

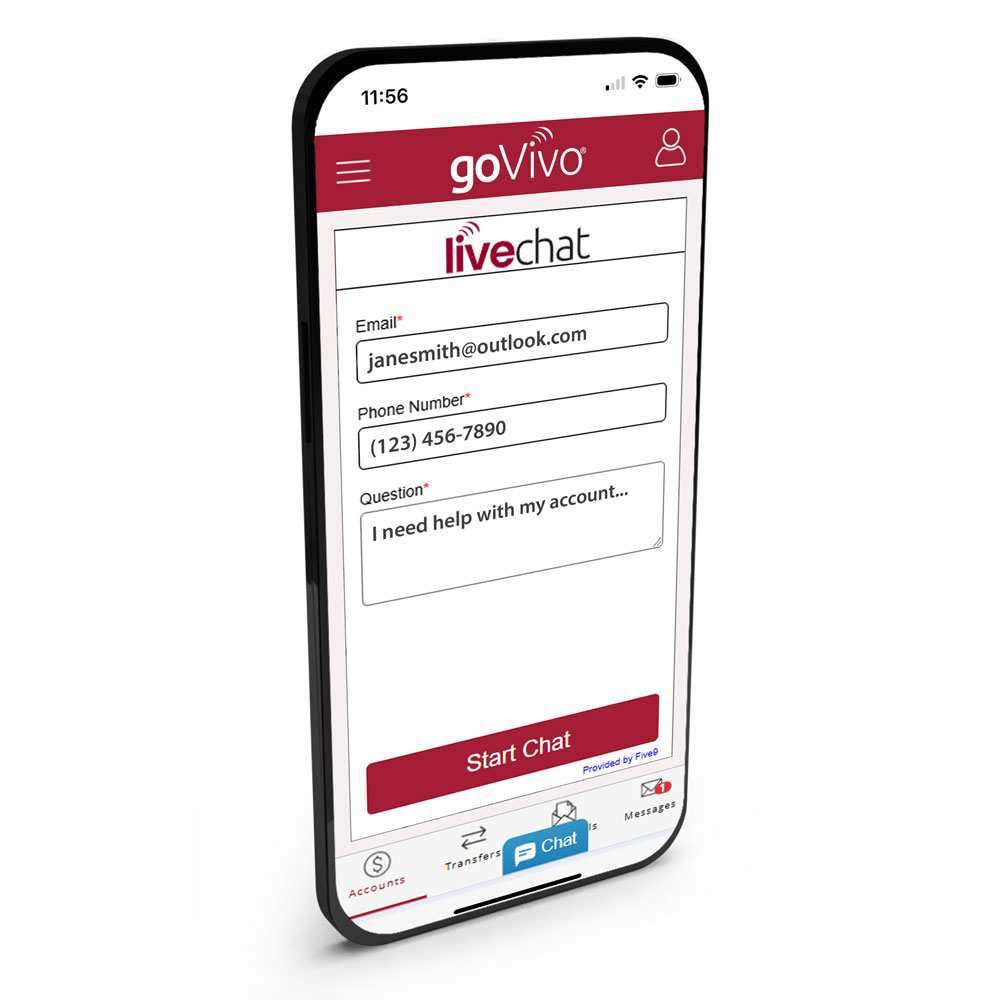

We’re excited to introduce goVivo® the online and mobile banking app with powerful new features designed to enhance your banking experience. The new application now includes an advanced Personal Financial Management (PFM) tool that helps you easily track spending, set budgets, and achieve your financial goals. Plus, with the added live chat capability, you can now get real-time assistance from our customer support team whenever you need it.

Upgrade Your Online Banking Experience

Enjoy exciting features such as:

New Personal Financial Management Tool

goVivo® features a brand-new Personal Financial Management (PFM) experience designed to make managing your money easier than ever. Robust insights on activity give a clearer picture to your finances…

Holistic Financial View

Customers can see all their financial accounts (across institutions) in one place, providing a complete picture of their financial health.

Better Financial Decision-Making

By categorizing transactions and analyzing spending trends, the tool helps customers identify spending patterns, cut unnecessary expenses, and allocate funds more effectively.

Personalized Budgeting

Users can set budgets tailored to their income and expenses, helping them stay on track with their financial goals.

Goal Achievement

Customers can set and monitor progress toward financial goals, such as saving for a vacation, paying off debt, or building an emergency fund.

Improved Security

With real-time alerts for unusual transactions, the tool enhances customers’ confidence in monitoring and protecting their accounts.

Time-Saving Automation

Automated transaction categorization and easy-to-read dashboards save customers time compared to manual budgeting and tracking.

Enhanced Customer Experience

Intuitive design and actionable insights make financial management more engaging and less intimidating, fostering a sense of control and empowerment.

Reduced Financial Stress

By providing clarity and tools to manage finances effectively, it helps customers reduce anxiety about money management and improve their financial well-being.