Welcome to the Fraud Security Hub, where your security is our top priority!

As fraud tactics continue to evolve, it’s essential to stay informed about potential threats and protect your personal and financial information. Here’s how you can safeguard your accounts and recognize signs of fraud.

FRAUD ALERT!

A Fraudulent Fraud Department

Recently, customers have received phone calls from individuals claiming to represent the bank’s Fraud Department. The callers request personal information and eBanking credentials, resulting in fraudulent activity on customer accounts and debit cards.

Please note: Our Fraud Department does not contact customers directly under any circumstances.

Common Types of Threats

Scams are prevalent threats that can impact anyone, often disguising themselves as legitimate opportunities or urgent requests. Recognizing the most common types of these schemes is key to protecting yourself and your financial well-being.

Phishing

Fraudsters may send emails, texts, or phone calls posing as Ridge View Bank or other trusted entities. They often ask for sensitive information, like passwords or account numbers. Remember: Ridge View Bank will never ask for your password or PIN.

Impersonation Scams

Scammers may pose as bank representatives, government officials, or even family members in distress to convince you to transfer money or share sensitive information.

Card Skimming

Skimming devices can be attached to ATMs or payment terminals to capture your card information. Be vigilant about unusual-looking devices and shield your PIN when entering it.

Online Account Takeover

Hackers may try to gain access to your online accounts by guessing your password or through a data breach. Use strong passwords and enable two-factor authentication.

Scam of the Month: Stay One Step Ahead

Every month, scammers get smarter—but so do we. In this section, we spotlight the latest fraudulent schemes targeting consumers like you. Watch our three featured videos to learn how these scams work, see real-life examples, and find out how to protect your finances before fraudsters make their move. Knowledge is your best defense

April – “Pig Butchering”

“Pig butchering” scams are a fast-growing form of online fraud where victims are tricked into fake relationships—and then conned out of their life savings. Here’s what you need to know to spot the signs and stay safe.

March – Data Breaches

Data breaches are more common—and more dangerous—than ever. One wrong click, and your personal information could be in the hands of cybercriminals. Here’s how they happen, and what you can do to protect yourself.

February – Tax Scams

Tax scams are on the rise, and scammers are getting smarter. From fake IRS calls to phishing emails, here’s how these cons work—and how to avoid becoming their next target.

How to protect yourself online

Use strong passwords and update them regularly.

Choose unique passwords for each account and avoid using easily guessed information like birthdays or family names. Changing your passwords periodically adds an extra layer of security.

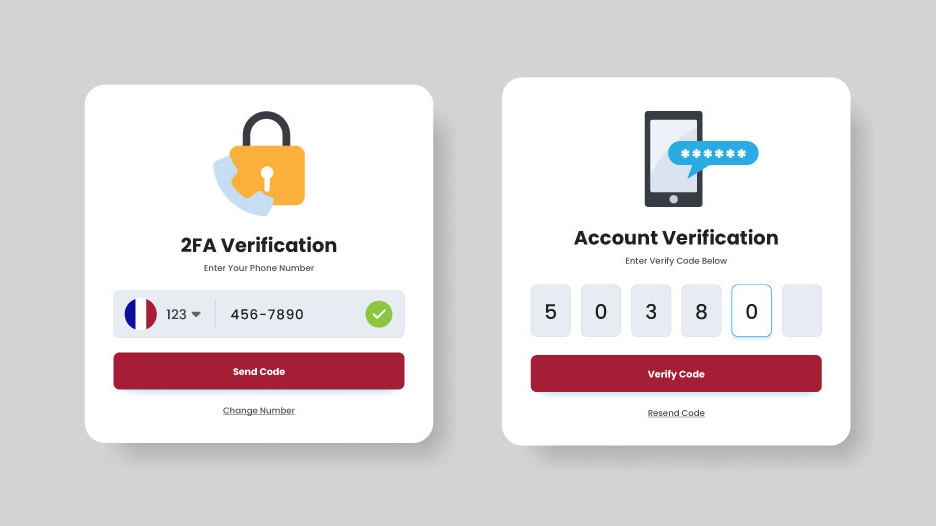

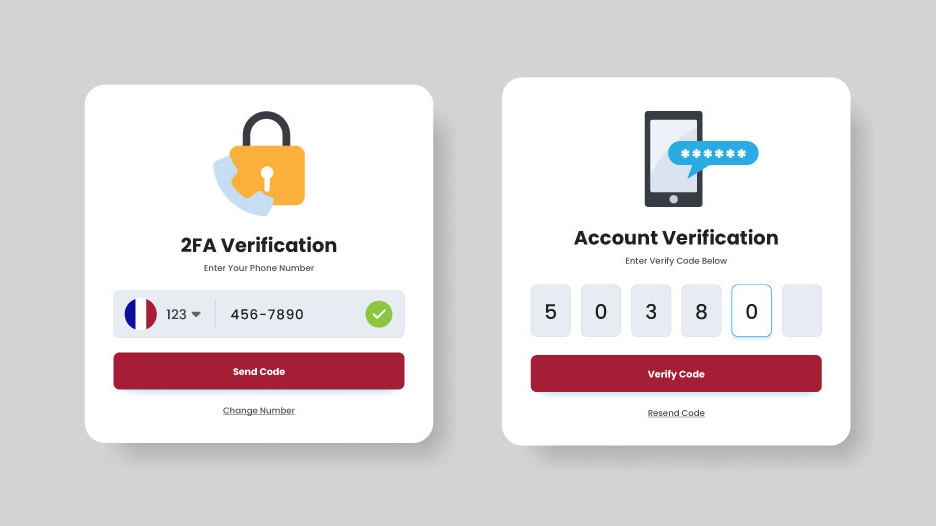

Enable two-factor authentication.

Wherever possible, enable two-factor authentication on your accounts. This requires a second form of verification, like a text message, in addition to your password.

Be cautious with public Wi-Fi.

Avoid logging into your banking accounts over public Wi-Fi, as these networks may not be secure. Use a VPN or wait until you’re on a secure network.

Verify requests.

If you receive a suspicious message or call, don’t respond directly. Contact your bank using a verified phone number to confirm if the request is legitimate.

Monitor your accounts regularly.

Regularly check your bank and credit card statements for unauthorized charges. Early detection is key to preventing further fraud.

How to protect yourself online

Use strong passwords and update them regularly.

Choose unique passwords for each account and avoid using easily guessed information like birthdays or family names. Changing your passwords periodically adds an extra layer of security.

Enable two-factor authentication.

Wherever possible, enable two-factor authentication on your accounts. This requires a second form of verification, like a text message, in addition to your password.

Be cautious with public Wi-Fi.

Avoid logging into your banking accounts over public Wi-Fi, as these networks may not be secure. Use a VPN or wait until you’re on a secure network.

Verify requests.

If you receive a suspicious message or call, don’t respond directly. Contact your bank using a verified phone number to confirm if the request is legitimate.

Monitor your accounts regularly.

Regularly check your bank and credit card statements for unauthorized charges. Early detection is key to preventing further fraud.

Banks Never Ask That

We will never ask you for sensitive information in suspicious ways, whether through emails, texts, or phone calls. Understanding what to watch out for can help you spot scams and protect your personal information.

Passwords, PINs, or Full Account Numbers

A legitimate bank will never request your password, PIN, or full account details over email, text, or phone. If someone asks for this information, it’s a red flag.

One-Time Codes or Verification Codes

Scammers often request one-time codes sent by your bank to access your account. Banks will never ask you to share these codes with anyone.

Personal Information by Email or Text

Banks will never send you a text or email asking for personal information, like your Social Security number, birth date, or credit card information. Legitimate messages from your bank are typically for alerts and updates, not information requests.

How to take action

*Educational Purposes Only. The materials and information compiled by Impressia Bank are intended for informational purposes only. Some of the information may be dated and may not reflect the most current resources. Any information provided by Impressia Bank shall not be considered advice, a recommendation or be construed in any way as a warranty, guarantee or promise. It should only be construed as information which is being provided and such information should be used by the Customer in their sole discretion and at their own risk. No particular results should be expected by the Customer. We are not offering any financial advice and the consumer is wholly responsible for how they use this information. We are providing information for the consumer to use and are not responsible for the use of the information by the consumer.